Contents:

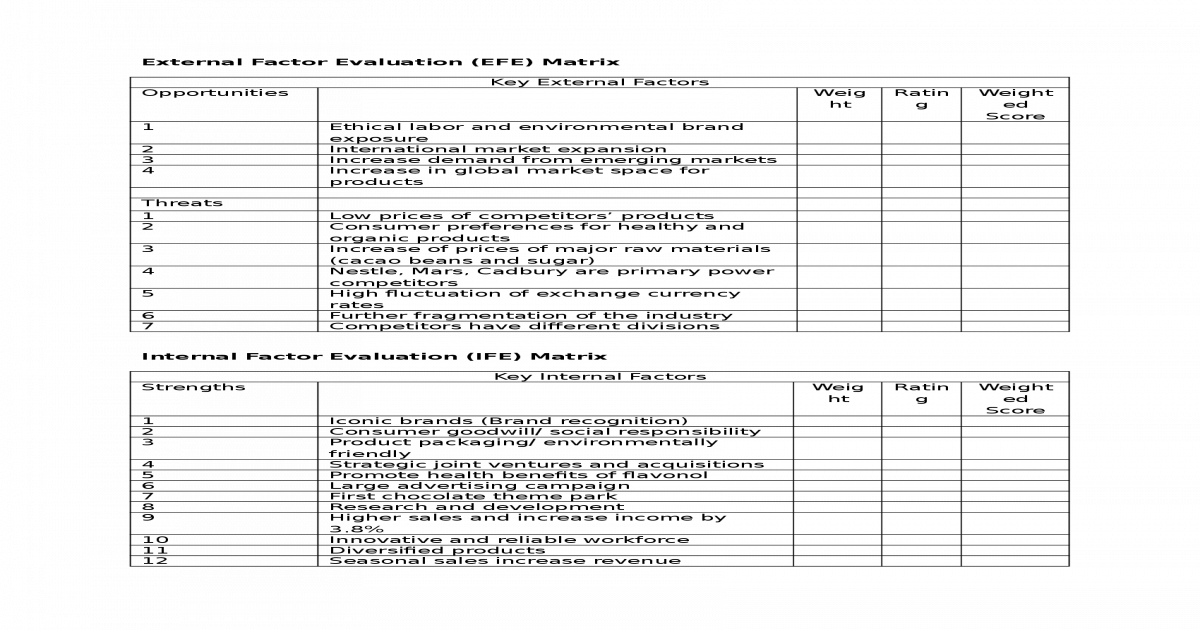

The irr vs cagr can be used to compare the historical returns of stocks to bonds or a savings account. CAGR is a good formula for evaluating different investment’s performance over time. XIRR compounds annually, but it has the ability to provide results based on inputs from any given day. However, daily compounding results in a higher effective rate compared to annual compounding.

Also, it helps in comparing the potential annual rate of return over time. In other words, it evaluates investment returns by considering both positive and negative cash flows. The primary difference between CAGR and XIRR lies in their consideration of cash flows. A CAGR return assumes all investments have been made at the beginning of the year, while XIRR considers periodic instalments as separate investments. Resultantly, XIRR provides an accurate picture of the mutual fund’s performance. IRR and CAGR are the same when you make a lump sum investment.

So if you look at the final amount of Rs 60,000, you could feel that your investment has doubled, or the absolute return on your investment is 100%, which is also true. Many new investors in various financial products are greeted by multiple terms like XIRR or CAGR. These terms even stump investors who have been investing for some time but suddenly check their statement one fine day. If you are one such person, you will obviously wonder what CAGR is or XIRR. Efiling Income Tax Returns is made easy with ClearTax platform.

What is IRR (Internal Rate of Return)?

However, there are other qualitative and quantitative factors for making investment decisions. If investing in market securities is giving a return higher than the above projects, then the business will rather invest in financial securities and earn a higher return. Apart from these two, the business also considers the cost of capital. Let’s assume the company’s cost of capital of buying new machinery is 8% and for investing in a new product is 10%. In this case, the business will be more profitable if it goes with new machinery as the cost of capital is less.

Return since launch One can ascertain the value of return since launch from the time an NFO gets closed. Now the next question is if CAGR is not the right measure for evaluating SIP investments, then what is? To calculate the Compounded Annual Growth Rate , we require – Initial Investment Value , Final Investment Value and the period of investment .

A lot has been covered in our blog since its inception, we have written articles ranging from the basics of financial statements to concepts of valuation. A reader who has followed our blog from the beginning should now be able to perform a detailed analysis of a company and arrive at a valuation for investment. It is easy to calculate a return if it has only one transaction of investments and redemption.

Calculators

You can use CAGR to compare the return on investment against a benchmark. Save taxes with Clear by investing in tax saving mutual funds online. Download Black by ClearTax App to file returns from your mobile phone.

For example, a company has to choose between two projects Project Alpha and Project Beta with IRR 20% and 25% respectively. The duration of project alpha is one year, while the duration of project beta is three years. If the company chooses project beta based on IRR, then the decision might not be favourable. Though the IRR is higher, the duration of the project is higher too.

Ultimately, being a smart investor is all about knowing what you want and then ensuring that you get it as envisaged. Use the ClearTax CAGR Calculator to check the annual growth rate of your mutual fund investments. You can compare the performance of the mutual funds with its peers or even a benchmark. You get an idea of whether you must invest in the mutual fund to get the return you desire. ROI is the return calculated on basis of the difference between the initial investment and the current or final value of an investment divided by the initial investment.

You can see, if you compound all the investment installments at IRR for the years these installments remain invested, you will end up with the right corpus amount. Because it considers only the annual percentage returns. You might feel that you will end with the same corpus because the CAGR is the same. CAGR is nothing but the geometric mean of returns for all the years you stayed invested. By calculating IRR for various investment patterns, we can determine which pattern of investment is more likely to provide a better return.

Reinvestment rate

Have you ever wondered “what does each kind of return signify? ” Or “Why not use a single kind of return in all types of investments? ” “What is the need to quote CAGR in lump sum investment while XIRR in SIPs? ” It is the awareness of these subtle yet significant differences that is going to take your investments to new heights.

However, if the pattern of payment is irregular, the Extended Internal Rate of Return is the formula of choice. Both IRR and XIRR calculation are also available in Microsoft Excel as a function. Let us look at the common types of returns and how they impact your investments. The table below shows that you earn XIRR at 48.98% when the return is computed on the same series of investments along with the time of investment as additional consideration.

CAGR just acts as a tool to smooth out the fluctuations present in an investment’s returns to make the figures comprehensible. Let’s assume that one invests Rs 2000 per month for a year in a fund, which increases to Rs 48,000 in 4 years. How to calculate the overall return on this investment made over 12 months? If using CAGR, you will have to measure the CAGR for 48 months on the first installment, for 47 months on the second installment, for 46 months on the third installment, and so on. Instead of doing that, one can use the XIRR function of excel that takes into account all these CAGRs to give the overall CAGR.

You make multiple investments and the annual returns are non-different. This will be the case with any volatile investment such as equities. Among these IRR is often considered to be a good measure of true returns.

What is Extended Internal Rate of Return (XIRR)

But it makes a couple of assumptions that may hinder its practical use. Firstly, it assumes that the compounding process is a smooth one over time with steady returns being made every year. Secondly, it assumes that a portfolio incurs cash flow only two times during its lifetime. One is at the very beginning when an investment is made and the second when the investment is sold and cash is returned to the investor. Microsoft Excel or Google Sheets calculate XIRR in mutual funds and SIP investments using the same steps.

Extended Internal Rate of Return or XIRR is defined as a single rate of return that can be applied to each instalment and possible redemption. Such application of XIRR allows you to determine the current value of the total investment. XIRR is especially useful for calculating returns on Mutual Fund SIP investments. All outflows like investments, purchases will be market negative while all inflows like redemption’s while are marked positive. In this type of case, in addition to the invested amount, the time of such investment also assumes significance to yield a certain outcome.

ROI vs. IRR: What’s the Difference in Calculation? – Investopedia

ROI vs. IRR: What’s the Difference in Calculation?.

Posted: Sat, 25 Mar 2017 19:18:05 GMT [source]

It is a variant of IRR and takes care of use cases when your cash flows are not periodic. It is therefore advisable to use Microsoft Excel Sheets for calculating IRR on mutual fund investments. It is essential to note that IRR can be used to calculate the rate of return if the investment is made on a periodic basis or at regular intervals and is not scattered. Mutual funds have been a popular investment product for the masses for a very long time. They provide the investors with many benefits like steady returns, lower cost or investment, lower risk, diversified portfolio, tax benefits , etc.

Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters. We advise our readers to add this to their ever-growing investing toolkit.

You may come across returns expressed in a variety of nomenclatures. Where ‘values’ represents a series of cash flows, the date represents a series of dates, and ‘guess’ is the random assumption for IRR. Here comes XIRR to calculate the accurate returns of any investment when there is a different amount or timeline used in an investment. In this case, there is no possibility of calculating the absolute return on the total amount invested in a year. Absolute returns are the way to calculate returns only if you invest Rs. 1 lakhs 10 years before and calculate the returns for the last 10 years.

You may ask what about returns for investments of less than or equal to one year? PS – We have a CAGR calculator that will help you calculate your mutual fund returns in no-time by just entering three above mentioned values. Investors & Analyzers can compare the CAGR of various investments in order to know how well one stock/mutual fund has performed against other against-market index. CAGR calculates returns based on the difference between initial investment and final investment value after considering the number of years of investment. ROI on the other hand is computed based on the returns earned by the investor while considering the initial investment without considering the years of investment. Let us say Mr. X is planning on investing ₹10000 in a project that is expected to produce cash flow ₹3500, ₹4000 and ₹5000 for three consecutive years.

CAGR is the most common mutual fund returns used when a fund’s performance is discussed. You can think of XIRR as nothing but an aggregation of multiple CAGRs. If you make multiple investments in a fund, you can use the XIRR formula to calculate your overall CAGR for all those investments taken together. Know about the various types of returns used to measure the performance of investments. Yes, absolute return does not give you the correct picture. If you want to find out CAGR for your investment over 5 years, you need to find out annual returns of 5 years.

- So, CAGR shows that your investment of Rs. 5 lakh earned an average annual return of 6.96% for five years, amounting to Rs. 7 lakh at the end of your investment horizon.

- We usually calculate the returns by CAGR, IRR, and XIRR.

- Thus, any investment will go through multiple ups and downs to reach the final top value.

- This is because the CAGR would give accurate results if there is only 1 cash inflow and 1 cash outflow in the investment.

On the other hand, XIRR simplifies the process of calculating returns, even if the investments are conducted at irregular investments. You can calculate the returns using an excel sheet wherein the XIRR function modifies the IRR and allows the flexibility to allot specific dates to individual cash flows. It assumes cash flows are reinvested; however, it doesn’t consider the reinvestment rate. One can also use the modified internal rate of return to estimate the investment returns. Modified internal rate of return considers the reinvestment rate as the cost of capital of a company. To summarise, investors can use historical CAGRs to compare different mutual funds’ performances.

Hence, unless an investor is making a lump sum payment, XIRR should be preferred over CAGR. The easiest method to calculate XIRR is through an excel spreadsheet or IRR calculator, as it includes multiple calculations for returns. Read all the documents or product details carefully before investing. WealthDesk Platform facilitates offering of WealthBaskets by SEBI registered entities, termed as “WealthBasket Curators” on this platform.

How much SIP should you make to get ₹1 Cr in 10 years via mutual funds? Mint – Mint

How much SIP should you make to get ₹1 Cr in 10 years via mutual funds? Mint.

Posted: Sat, 04 Mar 2023 08:00:00 GMT [source]

CAGR tells you the extent of return a fund provided you every year during this period. However, this is applicable only if you reinvest your gains every year. As we can see, at the end of the first year of investment, he earned a negative return of 0.35%. Moving forward, we see that his mutual fund investment returns in the second year has spurred to 15.82%, and in the third year it was at its peak, giving returns of 21.66%.

She is an MBA graduate and through her writing inspires many readers to start their investment journey. Her expertise lies in communicating a complex financial concept in a simplified way. As an entrepreneur, she believes in grabbing every opportunity that comes her way. She brings more than four years of financial markets expertise to the team. Hence the business will choose to invest in new machinery instead of investing in a new product as the cost of capital for this is less.